The terms ‘digital invoice’ and ‘electronic invoice’ (e-invoice) are often used interchangeably, but they hold distinct meanings.

Both sales invoices exist in a digital format, a digital invoice is a digitized version of a paper invoice, often in PDF or image format.

In contrast, an electronic invoice is created and exchanged in a structured electronic format. This enables automatic and integrated processing.

E-invoicing objectives

E-invoicing and digital invoicing interact differently with public administration systems. A digital invoice is like a traditional invoice, but an e-invoice goes through government platforms.

This process offers certain assurances regarding payments, as the involvement of public systems adds a layer of validation and reliability.

But, the primary motivation behind this integration with public systems is tax control. Governments use e-invoicing to decrease tax avoidance and make tax collection more efficient.

This article looks at e-invoicing requirements and formats worldwide. It shows how e-invoicing impacts businesses and discusses future trends.

Global shift to e-invoicing

E-invoicing refers to the exchange of the invoice document between a supplier and a buyer in an integrated electronic format.

The requirements for e-invoicing vary significantly across different regions, influenced by local tax regulations and government policies:

Europe:

The European Union is leading the way in adopting e-invoicing because of Directive 2014/55/EU. This directive requires electronic invoicing for public procurement. Italy and other countries have made e-invoicing mandatory for all domestic invoices.

Italy: Mandatory for all B2B and B2G invoices to be issued through the government’s Interchange System (Sistema di Interscambio, SDI).

Spain: Required for B2G invoices, with a common e-invoicing format (Facturae). Spain is preparing to adopt the Facturae format for B2B transactions – in the private sector.

Germany: Mandatory for B2G invoicing, with compliance to the XRechnung standard.

France: E-invoicing mandatory in B2B transactions by 2023, already in place for B2G.

UK: The UK follows its own standards, with mandatory e-invoicing in the public sector.

Latin America:

Brazil, Mexico, and Chile use advanced e-invoicing systems with strict regulations for electronic invoices. They also have real-time reporting to tax authorities.

Brazil: Nota Fiscal Eletrônica (NF-e) mandatory for all B2B and B2C transactions.

Mexico: Comprobante Fiscal Digital por Internet (CFDI) required for all invoices.

Chile: Electronic Tax Document (DTE) system in place, mandatory for all businesses.

Argentina: Mandatory e-invoicing for most businesses, with specific standards to follow.

Asia:

The adoption in Asia varies widely. Some countries, like South Korea and Japan, have advanced e-invoicing systems. Other countries are slowly implementing regulations. China, for example, has specific formats and standards that businesses must adhere to.

North America:

The US and Canada have a relaxed approach to e-invoicing without federal mandates. But people are using paperless transactions because they are efficient and better for the environment.

Formats and Interoperability

A major challenge in global e-invoicing is the lack of a unified standard. There are different formats like EDI, XML, and UBL that exist for exchanging data. Organizations like UN/CEFACT are working to ensure that these formats can work well together.

In this overview, we will look at how e-invoicing standards are used in different regions, with a focus on Europe and Latam.

Europe:

- UBL (Universal Business Language) – European Union: UBL files are invoices made in XML! Many EU countries have adopted UBL, especially within the PEPPOL network, for e-invoicing, particularly in public procurement. This is part of an effort to standardize e-invoicing across the EU.

- Facturae: In Spain, public administrations mandate the use of the Facturae format, an XML standard, for all electronic invoices.

- FatturaPA – Italy: The FatturaPA format, a specific XML schema, is compulsory for electronic invoicing within Italian public administration, particularly for B2G transactions.

- ZUGFeRD – Germany: ZUGFeRD, which combines PDF and XML, is gaining popularity in B2B and B2G transactions in Germany for electronic invoicing.

Latin America:

In Latin America, while each country has its own specific e-invoicing system, many of these systems do rely on XML-based formats. However, there isn’t a single, unified XML standard used across all countries. Instead, each country has developed its own XML schema tailored to its unique tax and regulatory requirements.

Brazil – Nota Fiscal Eletrônica (NF-e):

Brazil uses a specific XML format for its NF-e. This format is detailed and complex, designed to capture a wide range of transaction information for tax reporting purposes.

Mexico – Comprobante Fiscal Digital por Internet (CFDI):

The CFDI also uses an XML format. The Mexican tax authority (SAT) provides detailed specifications for this XML schema, which includes various types of fiscal documents, not just invoices.

Chile – Documento Tributario Electrónico (DTE):

Chile’s DTE system requires the use of a specific XML format for electronic tax documents, including invoices. The Chilean tax authority (SII) provides the XML schema which businesses must adhere to.

Argentina:

Argentina’s electronic invoicing system also uses an XML format, specified by the Administración Federal de Ingresos Públicos (AFIP). Each electronic invoice must conform to this schema for it to be valid.

Conclusions

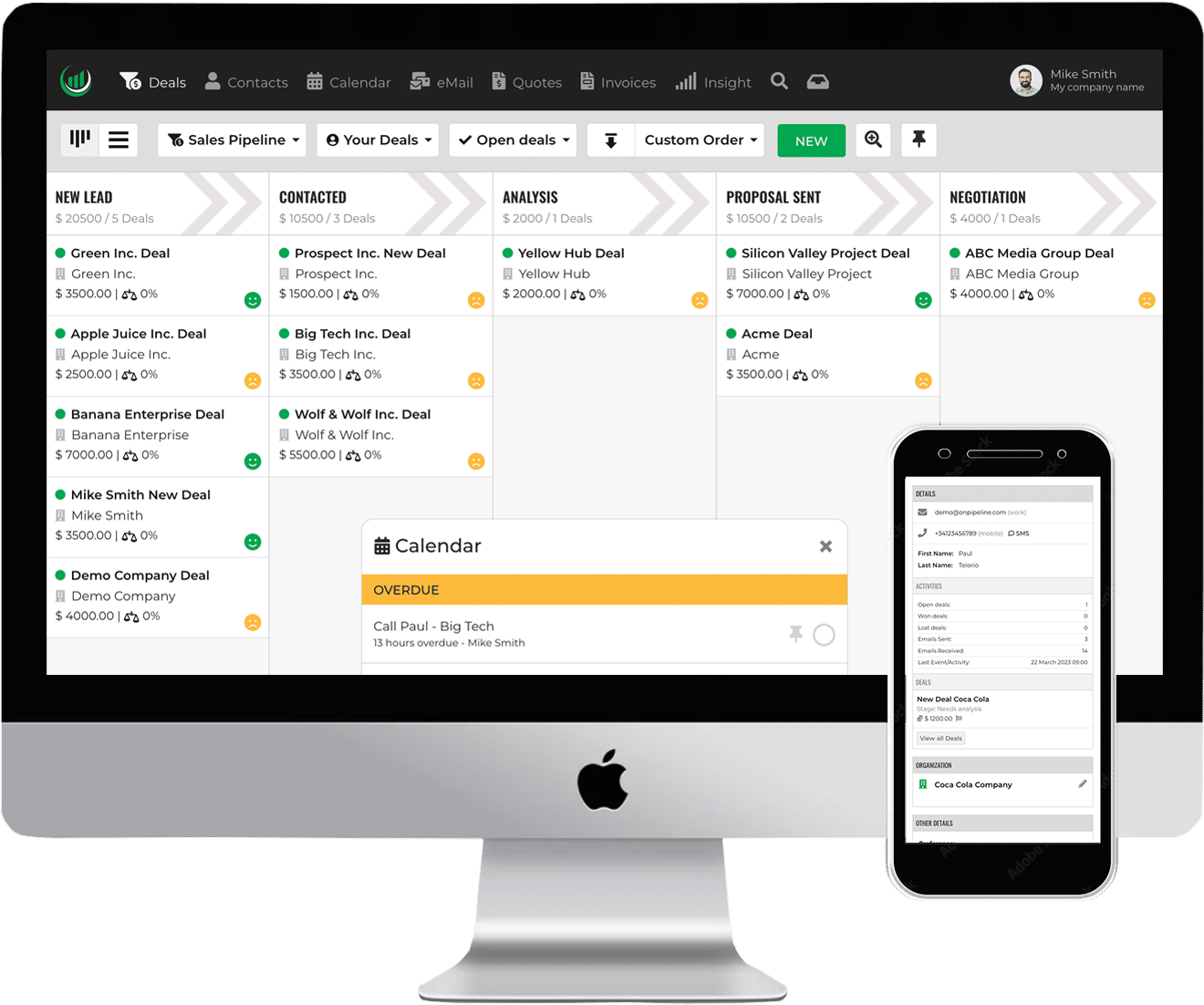

Companies like Onpipeline aim to make their crm invoicing software adaptable to international markets. However, they may not fully meet every country’s e-invoicing laws. In some countries, you might have to use local apps or third-party services for e-invoicing.

To succeed in a global business, you must know how to invoice in different countries. It is important to be aware of and adjust to these changes. This will help you follow the rules and use electronic invoicing. The growing use of e-invoicing makes global trade and finance easier to manage.